Gas Fees in Crypto: What Beginners Should Know and How to Manage Costs

One of the first surprises new crypto users encounter is the concept of gas fees. Whether sending tokens, using a decentralized exchange, or minting an NFT, users often find themselves paying much more than expected just to complete a transaction.

This guide breaks down crypto gas fees explained clearly and thoroughly—what they are, how they’re calculated, why they spike, and most importantly, how to manage them more effectively. Understanding gas fees is crucial for navigating blockchain networks like Ethereum with confidence.

What Are Gas Fees in Crypto?

Credit from ZenLedger

Gas fees are the costs required to perform actions on blockchain platforms that support smart contracts, such as Ethereum. These fees go to the validators (previously miners) who process transactions and maintain network security.

On Ethereum, each transaction or contract execution consumes gas, which measures the computational resources used. The more complex an action is—like interacting with DeFi apps or executing a contract—the more gas it consumes. The actual price you pay depends on how much gas is required and the going rate for gas at that moment, which is expressed in gwei, a fraction of ETH.

Following Ethereum’s EIP-1559 upgrade, every transaction involves two components: a base fee, which is burned (destroyed) to reduce ETH supply, and a priority fee—essentially a tip to encourage faster processing.

The total cost of a transaction is calculated as:

Total Fee = Gas Used × (Base Fee + Priority Fee)

Why Do Gas Fees Change So Much?

Credit from Jumpstart Magazine

Gas fees aren’t fixed. They fluctuate based on network demand, the nature of the transaction, and the underlying technology of the blockchain.

During times of heavy usage, such as NFT launches or bull market surges, users compete to have their transactions included in blocks. To prioritize their transaction, many offer higher tips. This bidding system drives up gas prices for everyone.

The type of transaction also plays a major role. For example, a simple transfer between two wallets typically requires much less gas than a multi-step interaction with a decentralized finance (DeFi) protocol. The more steps and logic involved, the more gas your transaction needs.

Lastly, the blockchain you’re using matters. Ethereum, while robust and widely adopted, is known for its congestion and high fees. In contrast, newer chains or Layer 2 networks are often designed with cost efficiency in mind.

How Gas Fees Compare Across Blockchains

Gas fees vary significantly between blockchains due to differences in consensus mechanisms, transaction throughput, and scalability features. Here’s a comparison of major networks as of mid-2025:

| Blockchain | Avg. Transaction Fee (USD) | Key Mechanism | Notes |

|---|---|---|---|

| Ethereum | $1–$50+ | PoS with EIP-1559 | High fees during congestion |

| Solana | <$0.01 | PoH + PoS | Ultra-low fees, fast but less decentralized |

| Binance Smart Chain | ~$0.05 | Delegated PoS | Low fees, but less decentralized |

| Polygon (Layer 2) | ~$0.01 | Ethereum-compatible sidechain | Popular scaling option for ETH |

| Arbitrum (Layer 2) | ~$0.03–$0.10 | Optimistic Rollup | Reduces Ethereum’s mainnet costs |

These numbers can vary daily, but the trend is clear—alternative or Layer 2 networks often offer dramatically cheaper fees than Ethereum’s mainnet.

Why Gas Fees Matter for Everyday Crypto Users

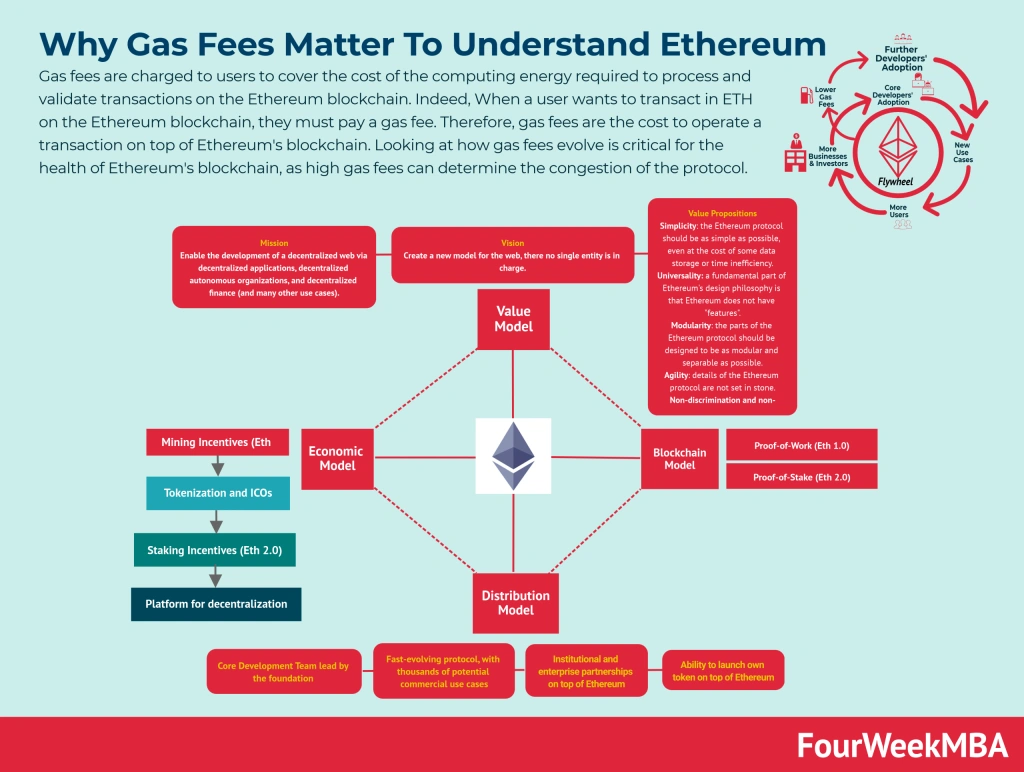

Credit from FourWeekMBA

Every action on the blockchain comes with a cost. For someone trading frequently, interacting with DeFi apps, or minting NFTs, gas fees can quickly add up and eat into profits. Even infrequent users can feel the pinch when the network is busy and fees are unusually high.

Many beginners overlook the impact of gas until they encounter failed transactions or realize they’ve spent more on fees than on the actual assets. Learning how to plan ahead and reduce gas costs is not only cost-effective but essential for a smoother crypto experience.

How to Reduce Gas Fees Without Sacrificing Functionality

There are several strategies you can apply to reduce how much you spend on gas fees—many of which don’t require advanced knowledge.

Start by monitoring real-time gas prices. Tools like Etherscan’s Gas Tracker, GasNow, and Blocknative show current rates and suggest optimal times to transact. In general, late-night UTC hours or weekends tend to be cheaper due to reduced activity.

Layer 2 networks offer another powerful way to cut fees. Solutions like Arbitrum and Optimism handle transactions off-chain and settle them on Ethereum later. This reduces congestion and lowers individual transaction costs significantly. For everyday use like token swaps, sending assets, or playing blockchain games, these platforms are becoming increasingly practical.

If you’re using Ethereum, adjusting your gas settings in a wallet like MetaMask can also help. While the default settings usually work, custom configurations may allow you to pay less without sacrificing speed—especially during calm periods.

In some cases, using different blockchains altogether may make more sense. Solana and Polygon, for example, offer compatible services with much lower fees. If your priority is speed and cost efficiency rather than network loyalty, these alternatives are worth exploring.

Lastly, some platforms offer gas rebates or fee subsidies as incentives. These promotions are most common in DeFi or during launch events, so keeping an eye on your favorite apps can pay off.

Debunking Common Misconceptions

It’s easy to misunderstand how gas works, especially when you’re new to crypto. Many assume gas fees are just flat transaction charges, like bank transfer fees. In reality, they’re tied to computational workload, network traffic, and voluntary bidding.

Another misconception is that failed transactions don’t cost anything. If your transaction runs out of gas partway through or encounters an error, the network will still charge you for the gas used up to that point. That’s why setting proper limits and estimating costs beforehand is so important.

It’s also not true that Ethereum is always expensive. With gas-saving features like EIP-1559 and wider adoption of scaling solutions, costs have become more manageable—especially for users willing to adjust timing and platforms.

Case Scenario: How a Token Swap Might Cost You

To put this in perspective, imagine you’re using a DeFi app to swap two tokens on Ethereum. The smart contract involved may consume 100,000 gas units. If the base fee is 35 gwei and you add a 5 gwei priority fee, the cost in ETH would be:

- 100,000 × (35 + 5) gwei = 4,000,000 gwei = 0.004 ETH

At an ETH price of $3,000, that’s a $12 transaction fee—potentially more than the value of the tokens being swapped. If you waited for a less congested time, the fee could drop by half.

Conclusion: Navigating Gas Fees as a Smarter Crypto User

For anyone stepping into crypto, understanding how gas works is just as important as knowing how to use a wallet or pick a token. While gas fees are part of what makes decentralized networks secure and functional, they don’t have to be a mystery—or a financial burden.

By using smart timing, leveraging Layer 2 networks, and exploring more efficient blockchains, even beginners can make savvy choices. As Ethereum evolves and the industry continues to scale, staying informed about how gas fees work in cryptocurrency will remain essential for smooth and cost-effective blockchain use.